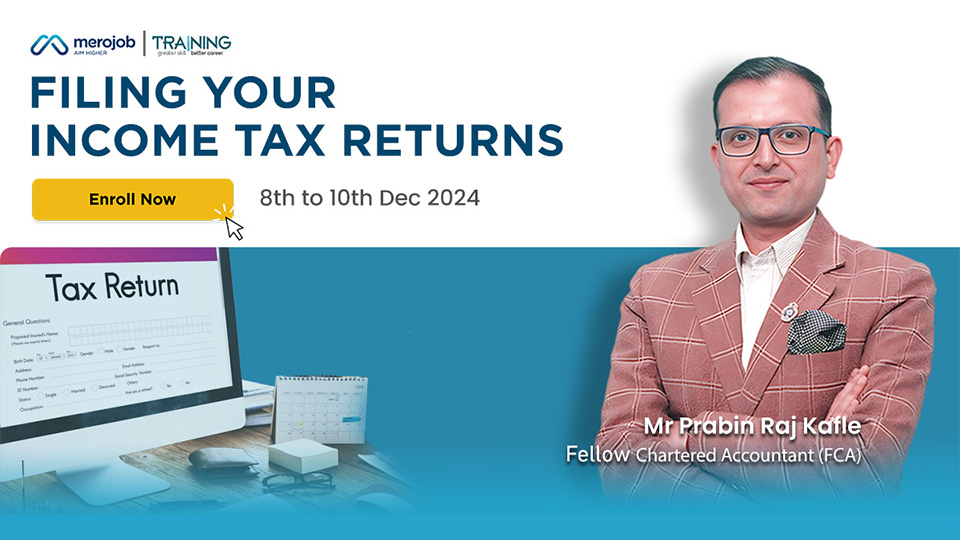

Filing Your Income Tax Returns Closed

As we witnessed the end of fiscal year 2080/81, it's crucial not only to finalize your financial statements but also to ensure your organization meets its compliance obligations. Among these, filing the Income Tax return stands out as a top priority. While auditors handle financial statements and tax calculations, many professionals still find the process of submitting the tax return through the Inland Revenue Department (IRD) portal complex and confusing.

The training on "Filing Your Income Tax Returns" will focus on equipping participants with the necessary knowledge and skills to efficiently navigate the IRD portal for filing their annual income tax returns. Participants will learn the step-by-step procedure for filing returns, including necessary document preparation, key compliance regulations, and common pitfalls to avoid. Through practical demonstrations and hands-on exercises, attendees will gain the confidence to complete their tax returns accurately with greater ease.

Course Content

This comprehensive training on "Filing Your Income Tax Returns" is designed to provide individuals and businesses with the essential knowledge and skills needed to effectively return the income tax in IRD Portal. The topics covered in the sessions are:

Day 1

Filing Income Tax Return: D01 and D02

Day 2

Filing Income Tax Return: D03

Day 3

D03 continue and Filing Income Tax Return: D04

Methodology of Training

Below is the basis modality for the delivery of the training:

- Virtual Session presentation by Trainer

- Polls and Q/A sessions at the end of session to make it more interactive

- Engaging

Payment Options

Advance payment prior to attending the training is a must. Payment options includes:

- Payment options includes: Online payment through merojob website, Bank QR, and Bank Transfer

- Payment once made is not refundable

After completion of this Course

- Resource files and template shall be provided

- Soft copy of Certificate of Participation will be provided.

(Training certificate shall be provided within 6 working days upon full attendance)

To enroll in the training, please ‘CLICK HERE’.