Training Overview

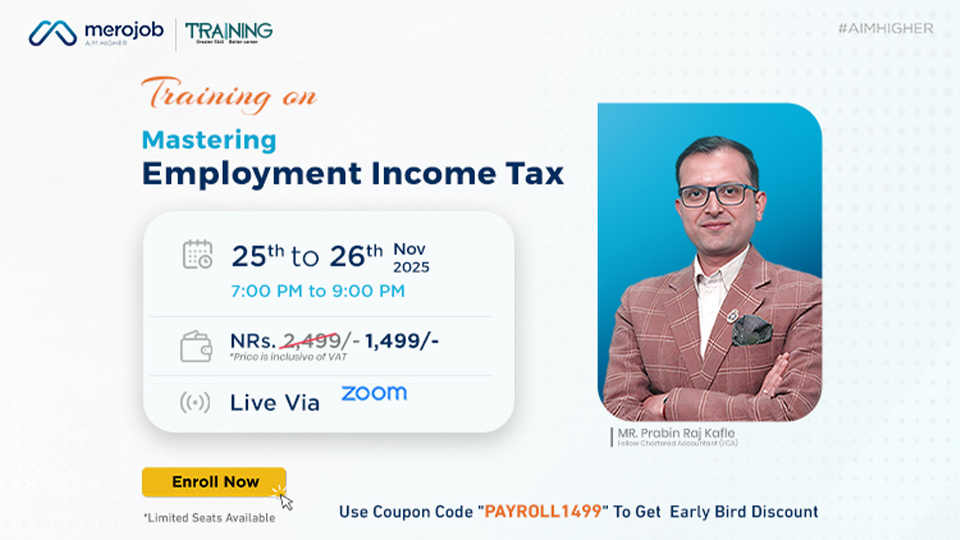

Managing employee payroll and taxation is one of the most crucial yet often complex responsibilities in any organization. This two-day intensive training on "Mastering Salary Income Tax in Nepal" is designed to equip HR, payroll, accounting, and finance professionals with the knowledge and skills required to compute salary, estimate income tax, and ensure TDS compliance with clarity and accuracy.

In addition to organizational payroll execution, the training also benefits employees who want to clearly understand how their salary is structured, how tax is calculated, what deductions are made, and how much they are legally required to pay. This helps employees make informed financial decisions, verify payroll transparency, and plan their personal taxes more effectively.

Through a blend of practical demonstrations, expert insights, and real-world case discussions, participants will gain hands-on knowledge of Nepal’s taxation framework, salary components, statutory deductions, and return filing requirements, enabling them to manage payroll operations more efficiently while also empowering employees to understand their own income and tax liabilities.

Course Content

This in-depth training on Calculating Salary and Its Tax is designed to equip HR, Payroll, Accounting, and Finance professionals with the practical knowledge and tools required to manage employee taxation effectively. The session topics include:

Day 1

Day 2

Methodology of Training

Payment Options

After Completion of the Course

(Training certificate shall be provided after completion of training within 6 working days upon full attendance)